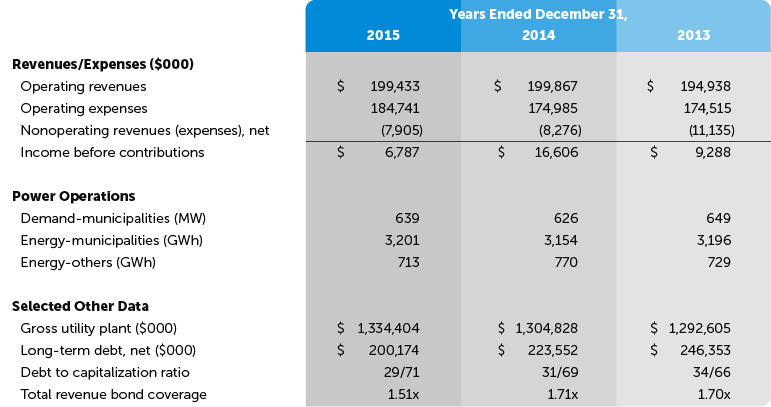

Platte River’s financial position remains stable although unfavorable results were reported compared to budget in 2015. Net income of $6.8 million exceeded the strategic financial plan target; however it was $3.1 million below budget. Revenues were the main driver of the overall lower net income primarily due to unfavorable surplus sales market conditions. Lower revenues were partially offset by under budget operating expenses. Debt service coverage – the ratio of total net revenues to debt payments and a source of confidence for holders of Platte River Power Authority bonds – was 1.51 times, well above the 1.10 times required by bond covenants.

Financial Highlights

Revenues, Expenses, Income (In thousands)

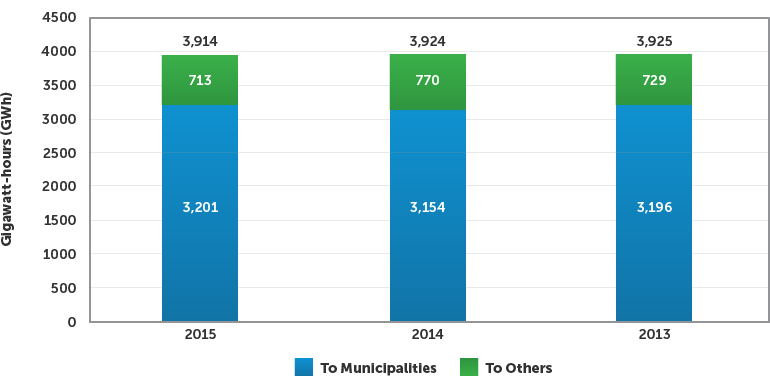

Energy Deliveries

To ensure that Platte River’s operational and financial goals continue to be met, the board of directors approved a 4.5 percent increase in the firm resale power service rate, effective January 1, 2016. The rate increase is primarily due to increased fuel costs, lower surplus sales revenues, energy efficiency program expansion, and staffing additions.

Platte River continues to be the lowest-cost wholesale electric supplier located in Colorado.